A partnership liquidation happens where the partners have decided that the partnership has no viable future or purpose, and a decision may be made to cease trading and wind up the business.

As with winding up a company, there are two ways that the partnership can be wound up; the creditor’s petition or the partner’s petition.

A creditor can petition to wind up a partnership, and at the same time decide whether or not to petition for the bankruptcy of each of the partners, some or none.

The partners can petition to wind up the partnership and also petition for their own bankruptcy or not. The partners may decide that instead of bankruptcy they would be able to contribute to IVAs.

A Partnership is treated much like a company and is wound up in the same way as a company. The tasks of the liquidator in the partnership liquidation are to:

Realise the assets of the partnership including any monies due on the individual partners. If a partner has entered into an IVA then only a proportion of these would be repaid. If they go bankrupt, then it is likely nothing would be repaid. All debtors, property and other assets would be collected by the liquidator.

Investigate the conduct of the partnership in the same way as the liquidator in a company liquidation must do.

-If the partners conduct warrants it, the liquidator can initiate actions against the partners to seek to disqualify them as partners in a partnership (Insolvent Partnerships Order 1994).

- The liquidator must also ascertain whether any transactions known as preferences or transactions at undervalue have taken place. If such transactions have been completed before the partnership liquidation, they can be un-done. The court can order that the partners reverse the transaction.

The liquidator completes his/her work by making payments to the creditors in order of priority.

If your partnership serves no further purpose or is experiencing financial difficulties that cannot be remedied there are certain advantages in initiating your own winding up liquidation. By taking such a partnership liquidation themselves the partners as individuals may avoid the disqualification of the partners and as company directors, however this will depend on their actions prior to the failure and whether they had acted at all times correctly and in the creditors’ interests.

" I found McCambridge Duffy to deliver on what they said they would do and to do so quickly with a minimum of fuss. There were not endless phone calls and letters but they got the facts, assembled the proposal and put it in place very quickly. The process was made less stressful by the way in which they managed it."

Work out what your new monthly debt repayment could be by filling in our debt and budget calculator form.

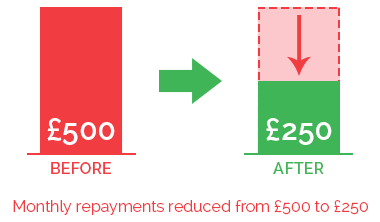

Client was struggling with monthly debt repayments of £500 to several creditors. We were able to have this reduced to £250 per month, with all interest and charges frozen. In 60 months, any remaining debts will be written off and they will be debt free.

Chat online with one of our debt advisors. We are available now to answer any of your questions.

© 2021 McCambridge Duffy Insolvency Practitioners.

All rights reserved

McCambridge Duffy LLP is a Limited Liability Partnership

registered in England and Wales.

Registered number OC309544

Registered office 17 Hanover Square, Mayfair,

London, W1s 1HT