A Debt Management Plan is an informal arrangement between you and your creditors where you agree to make just 1 affordable payment every month towards all of your debts. It is managed by a Debt Management company who will be responsible for all correspondence between you and your creditors.

A Debt Management Plan can be a good way of reorganising your finances if your are having difficulty with debts.

A Debt Management Plan lasts as long as you need it to. You usually continue your payments until your debts are paid in full, but you can opt out at any time, should you wish or if your financial circumstances change.

We are one of the leading Insolvency firms in the UK and have been in the financial industry since 1932. We solely provide IVAs and other Insolvency solutions. We do not offer informal debt solutions such as a Debt Management Plan, so if an insolvency solution is not your recommended course of action, with your permission, we will refer you to an appropriate agency/provider that can assist you further.

Remember all our advice is free so don't hesitate to contact us now!

If you would like to ask us any questions about about your debts call us on 0800 043 3328 or fill out the form on this page and we will be happy to advise you.

For more information on Debt Management Plans you can read our Debt Management FAQs.

" From start to finish they have been upfront and honest. They have helped me put my life back on track, thanks guys :-) "

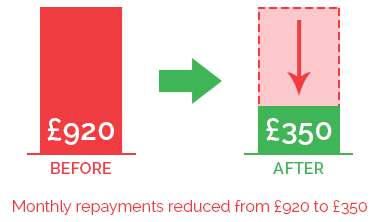

Work out what your new monthly debt repayment could be by filling in our debt and budget calculator form.

A couple were jointly paying creditors over £700 per month. We were able to have this payment reduced to £300 per month, with all interest and charges frozen. After 8 months of paying this reduced sum, they proposed to remortgage their home. This was successful and they released £19,000. Their creditors accepted this as a full and final settlement of their debts.

Chat online with one of our debt advisors. We are available now to answer any of your questions.

© 2021 McCambridge Duffy Insolvency Practitioners.

All rights reserved

McCambridge Duffy LLP is a Limited Liability Partnership

registered in England and Wales.

Registered number OC309544

Registered office 17 Hanover Square, Mayfair,

London, W1s 1HT