A typical IVA usually consists of affordable monthly payments that are made for a duration of 5 years, after which you are released from your debts and can start over debt free. However, in some cases an IVA could be a much shorter duration, if you have access to a lump sum amount of money, such as money from inheritance, or money from an asset. It could be possible to propose an IVA that uses this lump lum as "Full and Final Settlement" of your unaffordable debts. This type of IVA is sometimes referred to as a 'Lump Sum IVA' or a 'Full and Final IVA'.

The lump sum amount of money that creditors might accept as a settlement figure depends on:

If you would like to enquire about a Lump Sum IVA, click here to filll in the form, or continue reading to find out more.

To offer a 'Lump Sum IVA' you usually must qualify for an IVA under the normal criteria. You should:

The process of a lump sum IVA is similar to the five year IVA only over a shorter period of time. You will need the assistance of a professional called an Insovency Practitioner or IP. They will review your situation including your household income, expenses, and debts to make sure that a Lump Sum IVA is in fact your best option and to determine that there are not other more suitable options for your circumstances.

Before making an application the Insolvency Practitioner will request substantiating documentation in order to verify that all the information you have provided is true and accurate. Your IVA proposal will then be drafted and forwarded to you for review and signature. When you have reviewed the signed proposal the Insolvency Practitioner will send it to your creditors for their consideration and voting in a "Meeting of Creditors". At least 75% of your creditors (by debt value), must vote in favour of your proposal in order for it to be accepted. Some creditors may request certain modifications to the proposal before agreeing to it, which will be reviewed and discussed with you.

When creditors have voted and if your IVA is accepted, both you and the creditors will be bound by the terms of the arrangement for it's duration. Creditors that are included in your IVA will no longer pursue you for the debt involved and all interest and charges are frozen on the debts.

When the IVA is successfully completed, any remaining debts will be legally written off and you will be able to start over debt free.

Click here to read more information about an IVA and how it works, including the advantages and disadvantages of an IVA.

Every IVA proposal is unique, so we cannot guarantuee that your IVA proposal will be accepted, however it is worth noting that we have a very high acceptance rate, we have a good relationship with creditors and we would only put forward a proposal that we believe should be accepted.

An IVA can also be seen as an altnerative to Bankruptcy, so in some cases creditors would receive a better return in an IVA than in Bankruptcy, so this will also help them when deciding if they should vote in favour of or against your proposal. Fees for a lump sum IVA are generally less than five year arrangements as the IVA usually only lasts for a year or so. Any fees for administering and managing the IVA are decided and agreed by your creditors and will be deducted from the Lump Sum amount that you offer.

For more information on IVAs, please don't hesitate to contact us at McCambridge Duffy. You can call to speak with an advisor on 0800 043 3328 or fill in a form and we will get in touch with you.

Call now on 0800 043 3328 or click here to fill in the form on this page if you are interested in applying for a "lump sum IVA".

Read some feedback below about what our clients have to say about the services we offer. All reviews are collected on independent review site, TrustPilot.

To find out if McCambridge Duffy can help you regain control over your unaffordable debts, simply get in touch and we will advise you on all options available.

" McCambridge Duffy have been great, completely open, honest and non-judgemental from the first phone call. Kept me fully informed through every stage, always did exactly what they said they would and always got back to me promptly. Fully recommended."

Work out what your new monthly IVA repayment could be by filling in our debt and budget calculator form.

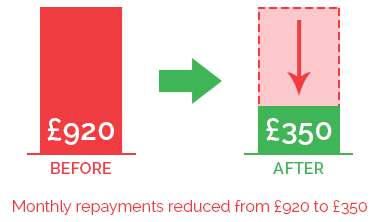

In the IVA example pictured above, our client was struggling with payments of £600 per month to their creditors. We were able to reduce the payment to £240 per month. After 60 months of paying this reduced amount, their IVA will be complete. Any remaining debts will be written off and they will be able to start over debt free.

Chat with one of our debt advisors. We are available to answer any of your questions.

© 2021 McCambridge Duffy Insolvency Practitioners.

All rights reserved

McCambridge Duffy LLP is a Limited Liability Partnership

registered in England and Wales.

Registered number OC309544

Registered office 17 Hanover Square, Mayfair,

London, W1s 1HT