Back in 2012 we noticed a significant swing away from bankruptcies and towards Individual Voluntary Arrangements or IVAs. It is interesting to look at what has been happening since then and particularly whether that trend has been sustained. The short answer is that it has and the numbers of individuals choosing bankruptcy continues to decline sharply.

Bankruptcy statistics

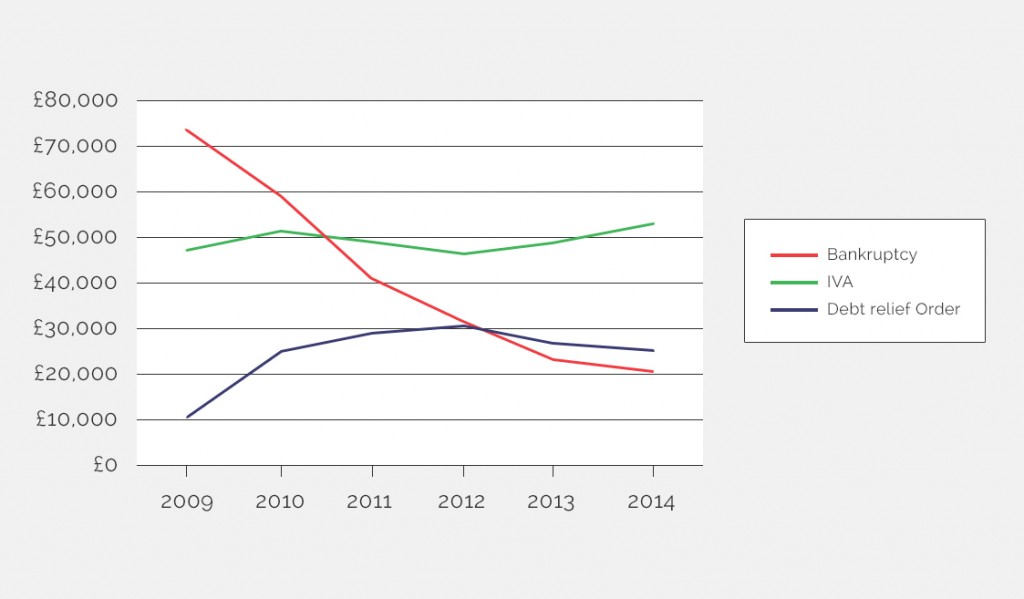

In England and Wales there were 74,670 bankruptcies in 2009; 59,173 in 2010; 41,876 in 2011; 31,787 in 2012; 24,571 in 2013 and 20,318 in 2014, a drop of over 17% in the last year.

IVA statistics

How have the figures for IVAs in England and Wales changed in the meantime? In 2009 there were 47,641 IVAs accepted. That increased to 50,693 in 2010, dropped to 49,058 in 2011 and dropped again to 46,674 in 2012. The last two years however have seen the number of IVAs increase to 48,881 in 2013 and most recently to 52,190 in 2014, an increase of about 7% in 2014 compared to 2013.

Debt Relief Order statistics

A contributory factor to these trends was of course the introduction of Debt Relief Orders or DROs in 2009. The figures for DROs in England and Wales were 2009: 11,831; 2010: 25,179; 2011: 29,009; 2012: 31,179; 2013: 27,546 and 2014: 26,688. This amounts to a reduction of 3% in the last year. Debt Relief Orders are limited to insolvent persons with unsecured debts of less than £15,000, no assets other than certain exempted low value items and low disposable incomes (less than £50 per month).

These trends are being replicated in Scotland and Northern Ireland. In 2014 there were a total of 11,621 individual insolvencies in Scotland, a fall of 51% from the peak of 2009 and the lowest annual figure since 2004. Individual insolvencies in Scotland consist of Sequestrations & LILAs (similar to bankruptcies and DROs) and Protected Trust Deeds (similar to IVAs). All of these individual insolvencies are reducing at a current annual rate of about 7% in Scotland.

The statistics for Northern Ireland show that there has been a gradual increase in the number of personal insolvencies since 2007 with a total of 3,395 in 2014, up 1% over 2013. The increase has largely been driven by the increase in IVAs since 2007. The numbers of bankruptcies and DROs in northern Ireland have been relatively flat over the last four years of that period.

What conclusions can we draw from these personal insolvency figures?

The figures for DROs in England, Wales and Northern Ireland appear to have reached a plateau with growth being flat or negative apart from IVAs. In Scotland the trend is definitely downward.

Bankruptcies show a definite and sharp downward trend when you take all four regions together.

IVAs appear to be the most buoyant of the various insolvency solutions with England and Wales increasing by 7% in 2014 as compared with 2013. These trends suggest that debtors are showing a marked preference for the IVA vis-à-vis Bankruptcy as a solution to personal insolvency. Creditors do acknowledge that their returns from IVAs in terms of the amount of debt repaid are substantially better than what they can expect to recover from debtors who are forced into Bankruptcy or voluntarily choose that route. In particular creditors seem to have begun to accept that debtors in IVAs should have a reasonable standard of living over the term of their IVAs and that they should not seek to trim back the debtor’s expenditure projections to the point where any unexpected increase in expenditure or reduction in income causes the IVA to fail.

Falling property prices and the loss of equity has been a significant factor influencing the trends since in many cases it would not benefit creditors if the debtor were forced into selling his or her home in Bankruptcy. In an IVA on the other hand, there is the prospect that property prices will increase again in future years with the expectation that some equity will be present and realizable and available to be contributed into the IVA for the benefit of creditors. It also seems that the stigma of Bankruptcy is still a significant factor for many debtors. A further factor, not always acknowledged by creditors, is the genuine desire of debtors have to repay as much of their debts as they can and they see an IVA as the best route to do this while offering them some prospect of retaining their home and their dignity.

All figures and statistics included in this article are provided by The Insolvency Service. Statistics are based on the latest available data at the time of writing.

Contains public sector information licensed under the Open Government Licence v3.0.